Introduction

Claim denials are a persistent challenge in healthcare, significantly impacting revenue cycles and operational efficiency. Recent survey indicate, claim denial rates have surged by 20% over the past five years, a trend significantly worsened by the COVID-19 pandemic. They stem from a variety of preventable issues, ranging from simple administrative oversights to complex coding inaccuracies and policy non-adherence.

Navigating these pitfalls is essential for ensuring timely reimbursement and maintaining financial stability. This guide explores the most common reasons for claim denials, including coding errors, duplicate submissions, issues of medical necessity, and patient eligibility problems, among others. Understanding these core issues is the first step towards implementing effective strategies for prevention and successful claim resolution.

To understand more about clean claims

Read: Understanding the important characteristics of Clean Claims.

Common Reasons for Claim Denials

Coding Errors

Claim denials frequently arise from erroneous billing codes, including simple typos or the use of incorrect CPT or ICD-10 codes that don't reflect the services rendered. Furthermore, the persistent use of outdated ICD-10 or CPT codes, rather than the most current versions, is a significant reason for rejections. These coding inaccuracies, whether clerical or due to lack of updates, directly contradict payer guidelines, leading to the refusal of claims.

Duplicate Claims

Duplicate claims are a major reason for denials, occurring when the same service for the same patient on the same date of service is submitted multiple times. This often happens due to system glitches, resubmission errors, or a lack of proper tracking of previously sent claims. Payers automatically flag and deny these redundant submissions to prevent overpayment and maintain billing integrity.

Lack of Medical Necessity

Claim denials also frequently arise due to insufficient evidence of medical necessity, where the services or treatments rendered are not considered essential for diagnosing or managing the patient's condition as per payer criteria. These denials often result from inadequate documentation that fails to support the clinical justification for a procedure, test, or extended stay. As a result, billed services are viewed as elective, investigational, or inconsistent with accepted medical standards for the given diagnosis.

Patient Eligibility Issues

The 2024 Optum Revenue Cycle Index Report revealed that "Registration/Eligibility" was the primary driver of claim denials in 2023, accounting for nearly a quarter (~24%) of all rejected claims. Other causes include inactive insurance coverage on the service date or mismatches in demographic details compared to the insurer’s records. Apart from this, Errors in verification—like incorrect policy numbers or overlooked benefit limitations—can also trigger rejections.

Incorrect or Missing Data & Insufficient Documentation

The same report, also revealed that "Missing or invalid claim data" was the second most common reason for denials accounting nearly ~16% of all rejected claims. These denials are due to missing or incorrect details like patient info, insurance numbers, or provider data. Incomplete medical records—such as missing doctor signatures or poor documentation—also lead to rejections. Additionally, if the records don’t clearly support the billed services, like missing notes, test results, or unclear links between diagnosis and treatment, payers may deny the claim.

Non-adherence to Payer’s deadline policy

Most insurers enforce strict timeframes typically between 90 days and one year from the date of service for claim submission. Regardless of coding accuracy or medical necessity, missing these deadlines results in automatic denial under the category of “untimely filing.”

Out of Network Care or Provider

These types of denials arise when patients receive care from out-of-network providers or have been provided care that is not covered by the patient’s insurance plan. In the absence of prior authorization or documented medical necessity, insurers typically reject these claims, citing lack of coverage under the policy.

Missing Authorization

These happen when care is provided without securing the necessary approval. Insurers will deny claims if authorization was not obtained or if the services exceed the scope of what was approved. Absence of proper authorization then suggests that medical necessity or coverage requirements were not confirmed in advance, leading to an automatic denial.

Dual Coverage Issues

When a patient is enrolled in multiple insurance plans, it creates confusion over which payer is primary. If benefits aren't properly coordinated or the claim is submitted to the wrong insurer first, it is often rejected.

Unbundling

Unbundling is the situation where services that are typically performed together are billed separately rather than as a single, inclusive code. Payers consider this practice—known as unbundling—as an attempt to overcharge procedures already covered under a primary service code. As a result, such claims are denied for violating the payer’s bundling rules and reimbursement guidelines.

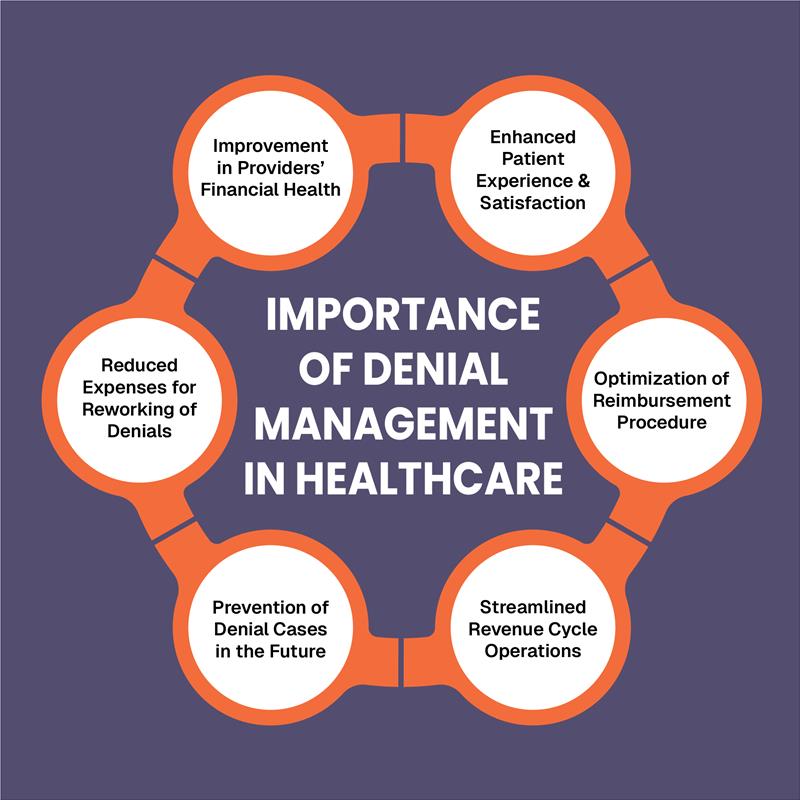

Impact of Claim Denials on Hospitals & Medical Practices

Lost revenue

Globally, healthcare systems lose approximately $125 billion each year due to RCM inefficiencies.

Increased administrative costs

Cost to rework a denial can be from $25 to $181, which contributes to multiple pain points in hospital’s cashflow

Delayed revenue

The average number of days it takes to receive reimbursement for a claim is typically below 50 days, which varies according to service, payer, and specialty. Thus, delayed revenue from payers due to denials creates a cash crunch which impacts the finances of healthcare organizations.

Patient satisfaction

Claim denials can lead to delayed treatments and increased out-of-pocket expenditure, causing frustration for patients. Unresolved or repeated denials often create confusion and distrust in the healthcare process. Ultimately, they negatively impact patient satisfaction and the overall care experience.

Compliance and Regulatory issues

Frequent claim denials may indicate gaps in documentation or coding, leading to regulatory non-compliance. They can trigger audits, attract penalties, and jeopardize accreditation or payer relationships.

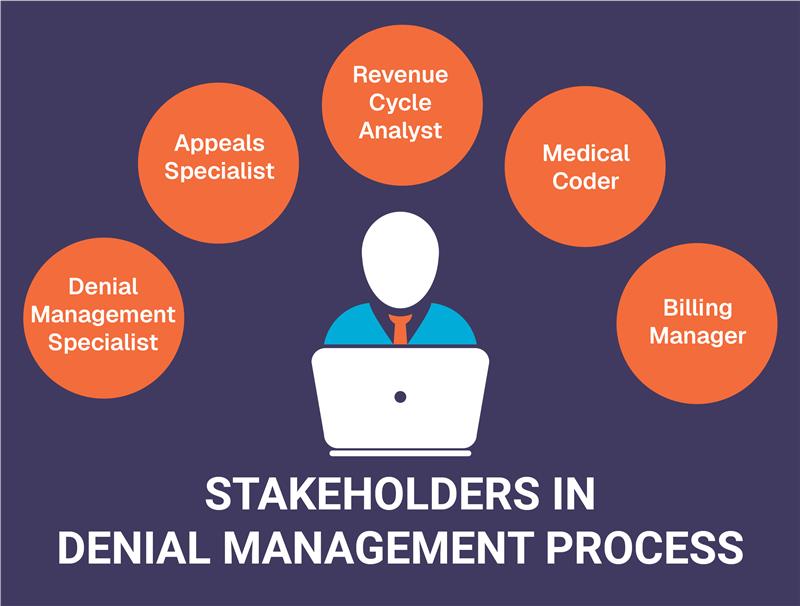

We at Pena4 understand the struggles of healthcare facilities

Hospitals and healthcare facilities often find denial management a cumbersome task, draining valuable net revenue, escalating administrative workloads, and even compromising the patient experience . At Pena4, we believe your focus should be on delivering exceptional patient care, not battling revenue leaks. Our dedicated team and specialized expertise allow us to streamline your claims process, having successfully brought our clients' average denial rates down to an impressive 5%. This frees your organization to concentrate on its true mission: enhancing patient well-being without the constant worry of financial shortfalls.