Introduction

The most important principle in financial accounting for revenue realization is, “revenue should be recognized when there is reasonable certainty of payment”. In 2025, up to 80% of medical claims are still estimated to contain errors - contributing to billions in lost revenue to healthcare establishments each year. This leads to rising claims denial rates, which eventually impacts the providers’ ability to provide better patient care and operate efficiently.

What is Denial Management?

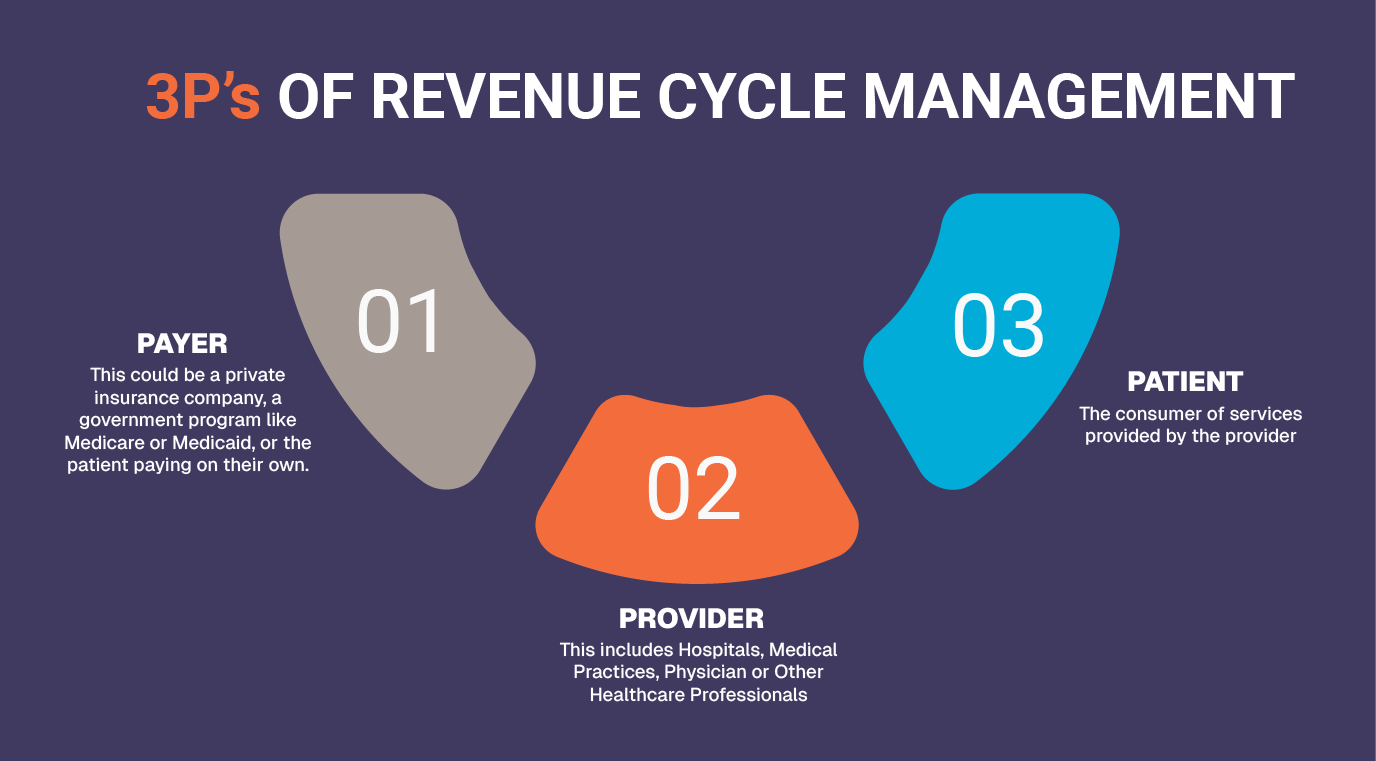

A claim denial occurs when an insurance company refuses to pay a healthcare provider—such as a hospital, doctor, or clinic—for medical services given to a patient who is covered under that insurance plan.

Denial Management aims to reduce these denials from payers, by identifying causes of denials, analyzing these causes, resolving problems, and preventing further occurrences of the same pattern of denials. Thus, denial management not only encompasses the traditional approach of resolving denials when they have happened but also prevents their occurrences in the future.

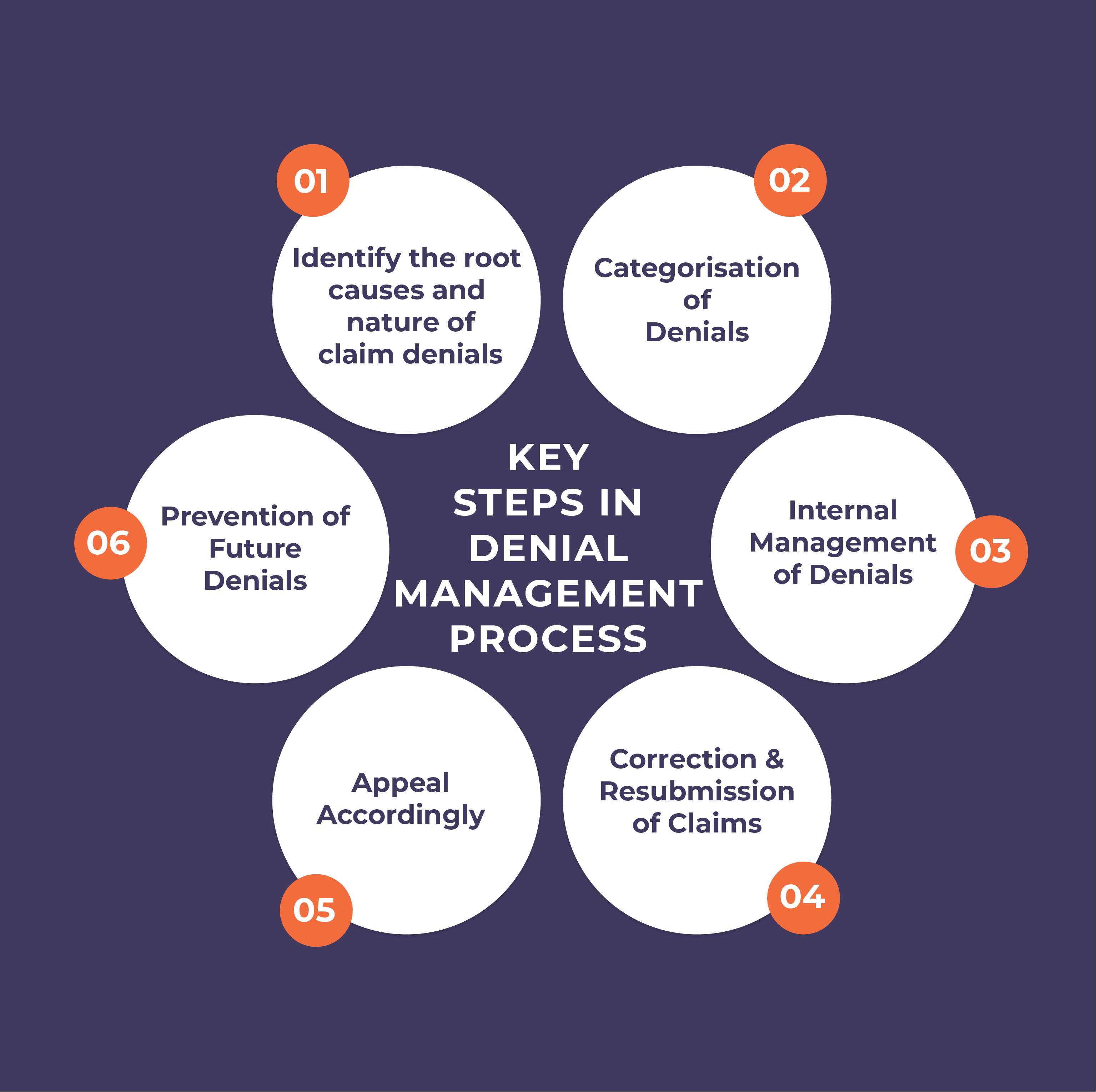

Key Steps in Denial Management Process

Identification of Root Causes of Denials and Nature of Denials

It's crucial to determine whether a claim was denied due to a human error or by the payer itself. A key step for billers is to diligently review Explanation of Benefits (EOBs) and Electronic Remittance Advices (ERAs). These documents are vital for pinpointing denials and their root causes. Additionally, payers provide Claim Adjustment Reason Codes (CARCs), which offer specific details to help billers identify the exact reason for each denial.

To know more in detail about the causes of claim denials

Read: Why Denials happen? List of common reasons for claim denials in a healthcare organization.

Categorization of Denials

Denials can be categorized based on causes of denial (coding errors, missing documentation etc.), service, specialty, claims amount, claims age, payer, location and/or provider. Denial categorization helps identify the root cause of why a claim was rejected, identifying trends in denials and guides the appropriate follow-up action.

Here's a simplified breakdown of common denial categories:

- Billing and coding denials

- Documentation denials

- Eligibility & coverage denials

- Authorization & timely filing denials

- Patient responsibility coordination of benefit (COB) denials

Internal Management of Denials

Assign each denial type to the team best equipped to prevent it. Teams might include – Front Desk, Registration, Advanced Authorization team, Coding Team, Billing Team and Accounts Receivable.

Assigning denials to the right department can help ensure quick resolution of denials and bring in transparency and accountability among the employees. Apart from this, bringing in automation that routes denials directly to appropriate team can further reduce delays in claims resubmission.

Correction and Resubmission of Claims

Teams can rework on their claims for e.g. Medical Coders can rectify errors by assigning the right ICD-10 or CPT code , Front-end team can attach the missing documentation or fill missing data, billers can delete the duplicate claims etc.

Appealing the Denied Claims

When a commercial insurance claim is denied, there's usually a structured appeal process that begins with the insurer's internal review and can escalate to external reviews or even legal proceedings.

Similarly, the Social Security Act also establishes five levels of appeal process for Medicare claim denials.

Prevention of Future Denials

Denial Management should not only deal with resolution but also formulate processes to prevent them in first place. Some ways this can be done is – categorization of denials into two buckets – preventable & non-preventable, analyze the trend in denials based on payer, specialty, department etc., embracing automation and digitization of routine processes and double-checking claim before submission.

To know more about various strategies to reduce denial rates

Read: Crack the Denial Management Strategy.

Benefits of Managing Denials in a Healthcare Organization

Improved Clean Claims Rate

According to Beckers ASC, Providers should aim to achieve 98% clean claims rate, for maximum revenue

Increased Net Revenue Collection

Savings realized from reduced rework can be anywhere from $25 to $181 per claim, which improves the net revenue collection of healthcare providers

Enhanced Patient Experience

With rising denial rates by Insurance companies and out of pocket expenditure for services by patients, an effective denial management strategy, promotes patient loyalty and better attrition rates

Reduction in Revenue Leakages

Since denials can shrink net patient revenue by as much as 5% and lead to losses of hundreds of thousands of dollars for hospitals, denial management thus brings benefits by enabling reductions in revenue leakages and bumping up hospital revenues in the process.

Reduced Administrative Workload

As resubmitting denied claims requires fewer resources and less manpower

Smoother operations

The revenue saved from denied claims can be reinvested into enhancing healthcare facilities and infrastructure.

Challenges faced by Healthcare Practices in charting an effective Denial Management Strategy

Lack of Appropriately Trained Staff in Denial Management

In fact, up to 24% of claim denials are caused by registration errors. Staff in physician practices, particularly smaller ones, juggle numerous administrative tasks and roles, all while navigating constantly evolving industry and regulatory landscapes. This leads to reduced time for denial management.

Lack of Automation

According to July 2021 Report, 31.0% of the U.S. healthcare providers were using manual claim denial procedures thus experiencing a huge amount of delay and recurrent errors in the process.

Lack of Financial Resources

A Becker's Hospital Review survey revealed that commercial payer underpayments cost healthcare providers, on average, 1-3% of their annual net patient service revenue

Pena4, your trusted partner with more than 27 years of experience in denied claims resolution

Are denied claims costing your organization? At Pena4, we possess both skilled personnel, and the deep knowledge required to efficiently overturn claim denials. We've a proven track record of recovering millions in previously lost revenue for our clients, consistently achieving an industry-leading denial rate of around 5%. Don't let valuable funds slip away. Connect with Pena4 today and let us help you transform your revenue cycle challenges into financial gains.