The year 2026 is poised to be a tipping point for Healthcare Revenue Cycle Management (RCM). As a C-level executive, you're not just managing a process; you're safeguarding the financial viability of your enterprise against a converging storm of challenges: unprecedented regulatory shifts, aggressive payer audits powered by Artificial Intelligence (AI), and sustained workforce shortages.

The industry’s average denial rate hovers near 10%, translating to billions in lost and delayed healthcare revenue. For top-tier organizations, simply managing denials reactively is no longer a viable strategy. The new imperative is denial prevention. Your leadership must shift from denial management (chasing claims) to denial prevention strategy (fixing root causes).

This blog outlines the three non-negotiable strategic pillars: front-end RCM, clinical documentation integrity (CDI), and advanced RCM technology, that must be the focus of every RCM leader in 2026.

The Revenue Cycle Tipping Point: From Reactive Defense to Proactive Prevention

Strategic Pillar 1: The Zero-Tolerance Front-End RCM

The vast majority of preventable denials originate at the very beginning of the revenue cycle: the front end. In 2026, eligibility and authorization errors will spike due to high patient turnover, complex health plans, and the implementation of the new CMS Interoperability & Prior Authorization Rule.

1. Real-Time Eligibility and Benefit Verification

It is a profound financial oversight to render high-cost services without confirming coverage. The days of batch eligibility checks are over. Real-time eligibility verification (REV) must be embedded into the scheduling and point-of-service workflow.

- The Mandate: Implement real-time eligibility verification at every patient encounter, not just the first.

- Actionable Strategy: Leverage EDI 270/271 transactions integrated with your EHR/PM system. Your system should not only confirm active coverage but also flag patient financial responsibility, remaining deductibles, and co-pays. The goal is a clean claim rate above 95%.

2. Mastering Prior Authorization Reform

The new CMS rules going live in 2026 mandate faster payer response times and the use of Application Programming Interfaces (APIs) for electronic submission. Organizations not equipped for electronic prior-auth risk swift denials for “non-compliant submissions.”

- The Mandate: Design workflows to align with the new regulatory timelines and electronic requirements.

- Actionable Strategy: Invest in automated prior authorization platforms that use machine learning to identify services requiring pre-approval, initiate the request electronically, and track the status in real-time. This is not about efficiency; it's a compliance requirement to mitigate high-value denials.

Strategic Pillar 2: Elevating Clinical Documentation Integrity (CDI) and Medical Necessity

Payer audits are evolving. They are no longer focused solely on coding errors but are using advanced technology like Natural Language Processing (NLP) to cross-reference clinical notes against submitted codes. This scrutiny targets medical necessity and documentation precision, making clinical denials the fastest-growing and most difficult to overturn.

1. Data-Driven Coding Compliance

The upcoming ICD-10 code updates for 2026 will increase documentation requirements across multiple specialties. Failing to capture nuanced clinical details will lead to immediate claim rejections and increased audit exposure.

- The Mandate: Proactive training on the new code sets, especially those related to surgical procedures, complex diagnostics, and chronic care management.

- Actionable Strategy: Integrate Computer-Assisted Coding (CAC) tools to ensure coding specificity. Regular, targeted coding audits must move beyond checking for upcoding/downcoding and focus on the alignment between the physician's note and the billed service.

2. Strengthening Medical Necessity Support

A significant portion of clinical denials hinges on a lack of documented medical necessity. Payers are weaponizing Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs).

- The Mandate: Embed CDI as a core, multidisciplinary function, not just within the HIM department, but integrated with clinical staff.

- Actionable Strategy: Utilize AI-driven systems that can analyze clinical notes at pre-bill stage, to flag missing information that supports the billed CPT/ICD codes. This prevents the denial upstream and shifts the effort from denial appeals to denial prevention.

Strategic Pillar 3: Technology Investment and RCM Automation

In 2026, RCM automation moves from a competitive advantage to an operational necessity. As labor shortages persist and payer complexity rises, manual processes are a direct path to an unacceptable cost-to-collect and a high denial rate.

The Non-Negotiable 2026 RCM Technology Stack

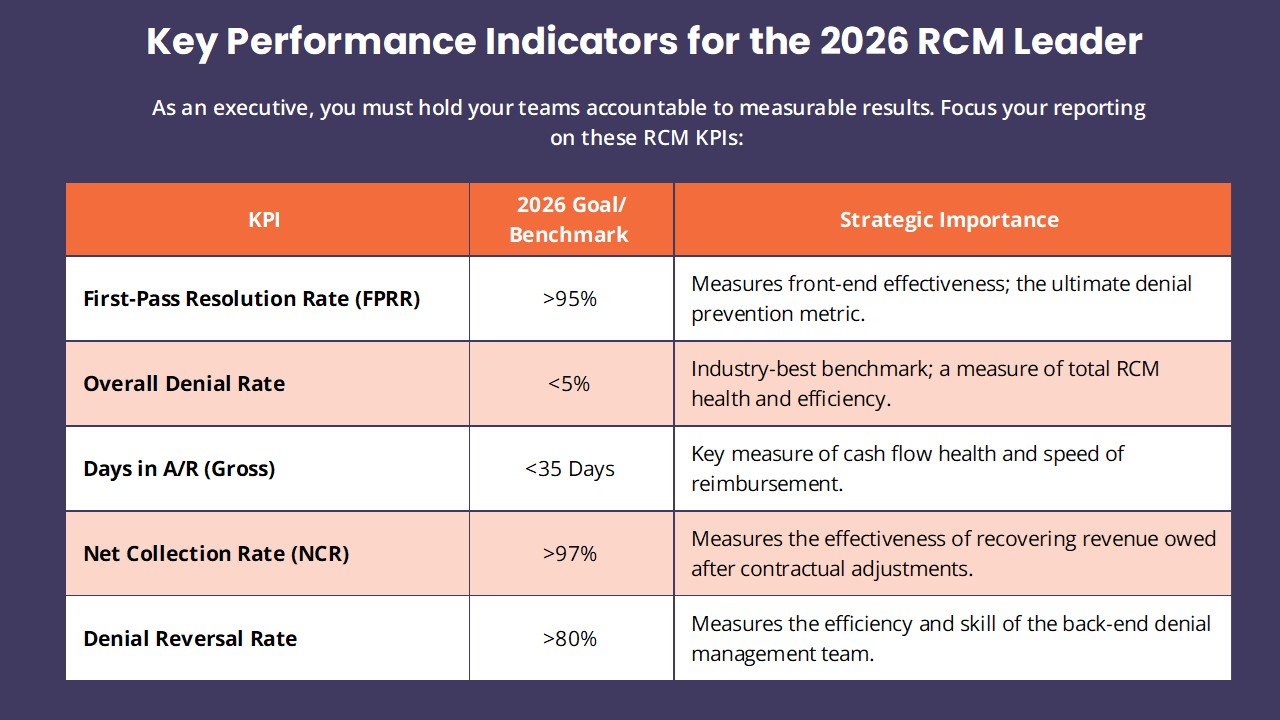

For RCM leaders to achieve a sub-5% denial rate and drive a clean claim rate above 95%, the underlying RCM technology stack must be unified, intelligent, and API-enabled. The following five components are mandatory for a proactive prevention strategy:

- AI-Powered Denial Prediction and Analytics:

- Function: This is the brain of the operation. It uses Machine Learning (ML) to analyze historical claim data, payer-specific denial patterns, and clinical documentation notes (NLP) to assign a denial risk score to every claim pre-submission.

- Impact: Shifts your A/R teams from managing hundreds of generic denials to focusing only on the 2–5% of claims flagged as high-risk, maximizing the ROI of human expertise.

- Intelligent Front-End Automation:

- Function: Integrates Real-Time Eligibility Verification (REV) (using EDI 270/271) and Automated Prior Authorization (leveraging payer APIs for electronic submission). This system must check benefits and medical necessity requirements upfront.

- Impact: Eliminates 70-80% of preventable denials (eligibility, benefits, and authorization errors) at the point of service, preventing revenue leakage before the claim is even created.

- Advanced Claim Scrubbing Engine:

- Function: Performs granular, payer-specific and rules-based edits beyond basic system checks. It validates modifiers, revenue codes, and NDC numbers against current payer guides, often leveraging Robotic Process Automation (RPA) for high-volume data validation.

- Impact: Drastically improves the First-Pass Resolution Rate (FPRR) by ensuring technical and administrative errors are corrected instantly, driving up the clean claim rate.

- Integrated Clinical Documentation Integrity (CDI)/Coding Tools:

- Function: Computer-Assisted Coding (CAC) and NLP tools analyze the physician's unstructured notes in the EHR against submitted CPT/ICD codes for coding compliance and medical necessity.

- Impact: Minimizes clinical denials and auditor risk by guaranteeing the clinical record supports the level of service billed, ensuring revenue integrity.

- Patient Financial Engagement Platform:

- Function: Provides mandated Good Faith Estimates (GFE), offers multiple digital payment options (mobile/portal), and automates patient-friendly billing communication.

- Impact: Boosts the self-pay collection rate, enhances patient price transparency compliance, and reduces administrative costs associated with manual patient collections.

The Compliance Risk in 2026: Beyond Denials

Compliance is the twin responsibility to denial prevention. The regulatory landscape is fraught with financial risk, and non-adherence can lead to penalties far exceeding lost claim value. RCM compliance in 2026 requires continuous vigilance.

1. The No Surprises Act (NSA) and Patient Price Transparency

Compliance with the NSA and maintaining accurate patient price transparency is a permanent fixture of RCM operations.

- The Mandate: Your organization must have robust systems to generate accurate Good Faith Estimates (GFE) for self-pay and uninsured patients and handle the complex Qualified Payment Amount (QPA) calculations for out-of-network claims.

- Actionable Strategy: Integrate your patient estimation tools with your scheduling and pre-registration workflows. Documentation of patient acknowledgment of the GFE is critical for audit readiness.

2. Value-Based Care (VBC) and Alternative Payment Models (APMs)

While not a direct denial prevention strategy, the shift to Value-Based Care fundamentally changes how your revenue cycle is managed. Financial success is tied to clinical outcomes and reporting.

- The Mandate: Establish an internal governance structure that bridges the clinical and financial sides of your organization.

- Actionable Strategy: Invest in analytics that can track the performance metrics required for Alternative Payment Models and risk-based contracts. Failure to report correctly is a form of revenue loss by non-compliance.

Conclusion: The New Mandate for RCM Leaders

The challenge of Denial Prevention & Compliance in 2026 is an opportunity for RCM leaders to redefine the financial health of their organizations. Success will not be found in incremental improvements, but in bold, strategic investments in RCM technology, front-end RCM automation, and the continuous education of clinical and financial staff on coding compliance and clinical documentation integrity.

The time for reactive denial management is over. The future belongs to the proactive prevention strategy, a strategy that demands executive oversight and a commitment to leveraging AI to ensure a healthy, compliant, and sustainable healthcare revenue cycle.